Taxes In Bankruptcy – When can tax debt be discharged in bankruptcy?

In A Nutshell

Taxes are difficult to discharge in bankruptcy unless specific requirements are met.

1) Priority Status Of Taxes

2) Income Taxes

3) Payroll Taxes

4) Property Taxes

Taxes In Bankruptcy In More Detail

1) Priority Status Of Taxes

Certain debts are given priority status in bankruptcy (both Chapter 13 and Chapter 7). These debts are typically unsecured debts (certainly not always) but do not receive the same treatment in bankruptcy as credit cards, personal loans, and medical bills. The typical priority debts are taxes owed to the government, child support, alimony, and student loans.

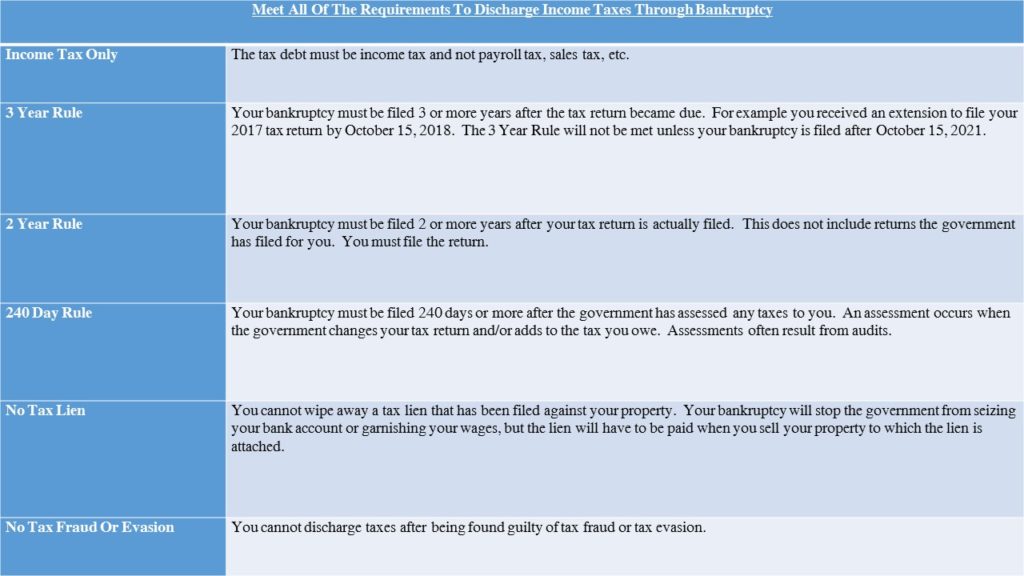

TAXES. Taxes have to meet specific requirements in order to be discharged through your bankruptcy. These requirements include:

(1) the type of tax debt and

(2) the age of the tax debt.

If the requirements are not met, then the taxes will have to be paid through your Chapter 13 bankruptcy payment or you will have to enter into a repayment plan with the government following your Chapter 7.

Let’s look at the most common types of tax debts and how they are treated in a Chapter 13.

2) Income Taxes

Income taxes are the most common form of tax issue that I see with individuals needing to file bankruptcy. Income tax liability often results from filing incorrect tax returns, failing to pay estimated taxes, or failing to have enough withheld from wages to pay the full tax owed. Regardless of how the liability was incurred, it is difficult to wipe away income taxes in a bankruptcy. The ability to do so depends on the timing of certain events. The chart below goes into detail on the timing issue. If you cannot meet the timing requirements, the tax has become a lien, or you have been found guilty of tax fraud or evasion, then the tax will not be discharged through your bankruptcy. If you can meet all of the requirements set out in the chart below, then the taxes owed will be treated as a non-priority unsecured debt (just like a credit card or personal loan). Keep in mind: do your best to pay any income taxes that become due during your Chapter 13. If you do not, then any tax liability incurred after you file your case could be added into your bankruptcy increasing your plan payment.

3) Payroll Taxes

Another common form of taxes that I see are payroll taxes (often called “941 taxes” or “trust fund taxes”). Here I am referring to the tax liability that results from the situation where you own a company with employees, withhold taxes for the employees, and fail to pay the withheld taxes to the government. When you fail to pay withheld payroll taxes both your company and you (personally) become liable for the taxes. Your personal liability for payroll taxes cannot be wiped away through a bankruptcy. Rather (in my experience), you will have to pay the payroll tax liability through your Chapter 13 payment or directly to the government following your Chapter 7. Often this type of tax debt liability can be extremely high, causing a very large, possibly unaffordable, Chapter 13 payment. For example: I have spoken with an individual who owned his own company and failed to pay nearly $150,000 of withheld payroll taxes. Because of interest and penalties, when we spoke the total liability had grown to $250,000. If he filed a Chapter 13, then the entire $250,000 would have to be paid through his 5 year Chapter 13 bankruptcy.

4) Property Taxes

Property taxes are those resulting from owning real or personal property located in a particular county in North Carolina. These taxes will NOT be wiped away through either type of bankruptcy. If you are not delinquent on your property tax and the tax due is simply for the upcoming year, then you can pay the tax directly to the county tax department. If you are delinquent and cannot make the full payment owed, then the property tax can be paid in full through your Chapter 13 payment or you will have to pay it directly to the government during or after your Chapter 7. Keep in mind: during the tenure of your Chapter 13, you will want to budget and pay your property taxes when they come due. If you do not, then the taxes will likely be added into your Chapter 13 causing an increase in your Chapter 13 payment.

If you owe taxes and feel that bankruptcy may be an option you need to explore, then fill out our online intake form to get your free evaluation from me. Completing the intake form does not obligate you to anything. Rather, I will respond quickly with my analysis and help you determine whether or not bankruptcy is an option for you to consider.

The sooner you start the process, the more control you’ll have over the outcome in your situation. There’s no cost and no obligation to fill out the iBankruptcy intake form and have me review your information. Don’t put it off any longer.

Get Your Free Bankruptcy Evaluation Today