What Does Chapter 13 Bankruptcy Do With The Debt I Owe?

In A Nutshell

1) Secured Debt

2) Unsecured Debt

3) Taxes

4) Alimony And Child Support

In More Detail

1) Secured Debt

Secured debts are those which the borrower (you) pledges an asset you own as collateral for the money that is loaned. The most common secured debts are a mortgage (secured by land) and vehicle loan (obviously secured by a vehicle). The result of not paying a secured debt is that the asset used as collateral is taken back by the creditor. This is often seen through foreclosures of people’s homes or repossessions of their vehicles

In a Chapter 13 and with most secured debts, you get to decide whether or not to keep or discharge the debt. For purposes of this discussion, I will use the example of a mortgage that encumbers your home on which you are 3 months behind.

Your 1st OPTION in a Chapter 13 is to keep your house. Through your monthly Chapter 13 bankruptcy payment you will pay (1) your normal monthly mortgage payments and (2) the amount you are behind on your mortgage (arrearage). At the conclusion of your bankruptcy you will have made all of the monthly mortgage payments that became due since the inception of your case as well as paid back all of the arrearage. Your house will be current, and you will begin making your mortgage payments directly to the mortgage company until the loan is paid in full. Bottom Line: if you are behind on your mortgage and want to keep your home, then filing a Chapter 13 will allow you to catchup your house payments by paying the arrearage owed through your Chapter 13 payment.

Your 2nd OPTION in a Chapter 13 is to surrender the house and walk away from the debt. When you surrender your home you give it to the bank. The bank is able to foreclose on the property and apply the proceeds from the sale to your mortgage balance. Obviously, you will have to find a new place to live, but you will no longer be liable for the mortgage or any resulting deficiency owed to the bank. In your Chapter 13, the mortgage will be treated as an unsecured debt which I will discuss below. Bottom Line: if you do not want to keep your home or its mortgage, then you can walk away from your home and wipe away your liability for the mortgage in a Chapter 13.

While it is true that with most secured debts you get to decide whether or not to keep the item, there are certainly situations where the Court will force you to surrender something. This can occur if you have too many secured items that the Court views as “luxury” items. For example: you have one residence with a mortgage (no problem) and one beach house with a mortgage that is not receiving any rental income (problem). The Court could force you to surrender the beach house because you are losing money on it each month. It is important to know what you are getting into before filing a Chapter 13. Fill out our online intake form to get a free evaluation of your situation and to let me guide you through this process.

2) Unsecured Debt

Unsecured debts are those where there is no collateral acting as security for the debt. The borrower (you) simply agrees to pay back the debt owed. The typical unsecured debts that individuals incur are credit cards, personal loans, and medical bills. The result of not paying an unsecured debt is that action is taken against you to “encourage” you to pay. These collection efforts often take the form of collection calls, collection letters, and lawsuits.

In a Chapter 13 unsecured debts may be paid a percentage of what they are owed. This percentage can be anywhere from 0% to 100%. At the conclusion of your Chapter 13 you will receive your discharge which will wipe away your liability for any remaining balance owed on unsecured debts. The question going into your Chapter 13 is: how much will you have to pay monthly to your unsecured creditors? This is based upon the following factors: (1) the value of your property and (2) your monthly disposable income.

Paying Unsecured Debts Because Of The Value Of Your Property. In a Chapter 13 you are given a certain value of exemptions for your property. I have explained exemptions in a separate post, but for now understand that you are allowed to own a certain value of property before the value of your property affects your case. If the value of your property falls above the exemptable limits, then the property is “unexempt.” In a Chapter 13 you must pay to your unsecured creditors an amount equal to the value of your unexempt property.

For example: your home is worth $95,000 and has no mortgage. The Law allows you to exempt $35,000 of equity in your home. This leaves $60,000 of unexempt equity, forcing you to pay up to $60,000 to your unsecured creditors in your Chapter 13. This equates to a monthly amount of $500 paid toward your unsecured debts ($100,000 – $35,000 = $60,000 / 60 months = $500/mo). You will not pay more debt than you owe. So, in this example if you owe less than $60,000 on unsecured debts, then you will pay 100% of those debts.

Paying Unsecured Debts Because Of Your Disposable Income. In a Chapter 13, the Court will look at your income versus your expenses to determine if, after paying secured and priority debts, you can afford to pay more to your unsecured debts. This is a multi step process that first looks at your last 6 months of household gross income. Your household income is compared to the income of other households in your area to determine if you fall above or below the “median” income. Falling above median will force your Chapter 13 to last for 60 months (as opposed to 36 or 48 months). If you fall above median, then certain expenses you have can be deducted from your gross income. If you have any surplus income after these allowable expenses are deducted, then you may be forced to pay something to your unsecured creditors.

Next, the Court will look at your present day income versus expenses…a snapshot of what your household budget will be today and going forward (rather than looking at your last 6 months). The Court is looking to see if you do or do not have the “ability to pay” any money to your unsecured debt. For this calculation, the Court will look at your household income, deduct your household expenses, and deduct the Chapter 13 payment if no unsecured debts were paid. If there is any surplus monthly income, then this will be added to your Chapter 13 payment to be paid to your unsecured debts. You must be certain that your expenses listed in your bankruptcy petition are accurate because they will be scrutinized by the Chapter 13 Trustee and the Court.

For example: your household income right now is $5,000, your monthly expenses are $3,000, and your base Chapter 13 payment (paying the mortgage, 2 cars, and attorney fee) is $1,500. This leaves $500 of disposable income that will have to be paid to your unsecured creditors, making your Chapter 13 payment a total of $2,000 per month.

3) Taxes

Certain debts are given priority status in Chapter 13. These debts are typically unsecured debts (certainly not always) but do not receive the same treatment in bankruptcy as discussed above. The typical priority debts are certain taxes owed to the government, child support, and alimony (I will talk about the latter 2 in the next section).

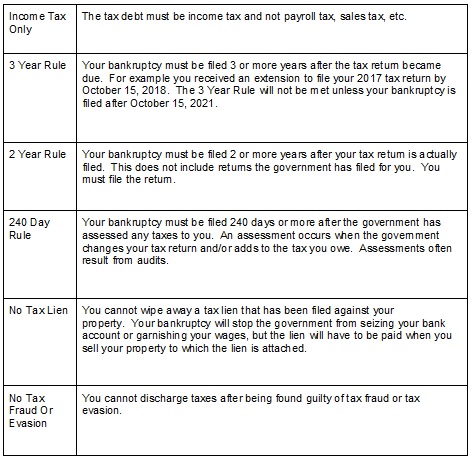

Certain factors have to be looked at regarding your taxes to determine if they must be paid through your Chapter 13 payment as priority debt or if they will be treated as general unsecured debt (akin to a credit card or personal loan) and be paid the same percentage as other unsecured debt (I have explained how to calculate the Chapter 13 payment in a previous post). These factors include: the type of tax debt and the age of the tax debt.

First let’s look at the type of tax debts and how they are treated in a Chapter 13.

Property Taxes. These taxes are those resulting from owning real or personal property located in a particular county in North Carolina. These taxes will NOT be wiped away through a Chapter 13 bankruptcy. If you are not delinquent on your property tax and the tax due is simply for the upcoming year, then you can pay the tax directly to the county tax department. If you are delinquent and cannot make the full payment owed, then the property tax can be paid through your Chapter 13 payment. By the end of the bankruptcy the taxes will be paid in full. Keep in mind: during the tenure of your Chapter 13, you will want to budget for and pay your property taxes when they come due. If you do not, then the taxes will likely be added into your Chapter 13 causing an increase in your Chapter 13 payment.

Income Taxes. Income taxes are the most common form of tax issue that I see with individuals needing to file Chapter 13. Income tax liability often results from filing incorrect tax returns, failing to pay estimated taxes, or failing to have enough withheld from wages to pay the full tax owed. Regardless of how the liability was incurred, it is difficult to wipe away income taxes in a Chapter 13. The ability to do so depends on the timing of certain events. The chart below goes into detail on the timing issue. If you cannot meet the timing requirements, the tax has become a lien, or you have been guilty of tax fraud or evasion, then you must pay the entire tax owed through your Chapter 13 bankruptcy payment. If you can meet all of the requirements set out in the chart below, then the taxes owed will be treated as a non-priority unsecured debt (just like a credit card or personal loan). Keep in mind: do your best to pay any income taxes that become due during your Chapter 13. If you do not, then any tax liability incurred after you file your case could be added into your bankruptcy increasing your plan payment.

Payroll Taxes. Another common form of taxes that I see are payroll taxes (often called “941 taxes” or “trust fund taxes”). Here I am referring to the tax liability that results from the situation where you own a company with employees, withhold taxes for the employees, and fail to pay the withheld taxes to the government. When you fail to pay withheld payroll taxes both your company and you (personally) become liable for the taxes. Your personal liability for payroll taxes cannot be wiped away through a Chapter 13. Rather (in my experience), you will have to pay the payroll tax liability through your Chapter 13 payment. Often this type of tax debt liability can be extremely high, causing a very large, possibly unaffordable, Chapter 13 payment. For example: I have spoken with an individual who owned his own company and failed to pay nearly $150,000 of withheld payroll taxes. Because of interest and penalties, when we spoke the total liability had grown to $250,000. If he filed a Chapter 13, then the entire $250,000 would have to be paid through his 5 year Chapter 13 bankruptcy.

4) Alimony And Child Support

As a general rule: alimony and child support are non-dischargeable through a Chapter 13. A Chapter 13 will not allow you to wipe away your liability for ongoing alimony or child support payments nor past due alimony or child support. Rather, you will continue to pay these things under the current terms which are unalterable by the bankruptcy. Keep in mind: you must stay current on alimony and child support while you are in the bankruptcy. Becoming delinquent during your bankruptcy can cause your case to be dismissed.