What Happens to My Car if I Declare Chapter 13 Bankruptcy? – 4 Things To Know

Click Here For Your Free Bankruptcy Evaluation

Your Car in Chapter 13 Bankruptcy – In A Nutshell

1) Paid Off

2) Pay The Value VS. Pay What Is Owed

3) Cramdown The Interest Rate

4) Option: Turn In The Vehicle And Discharge The Debt

In More Detail

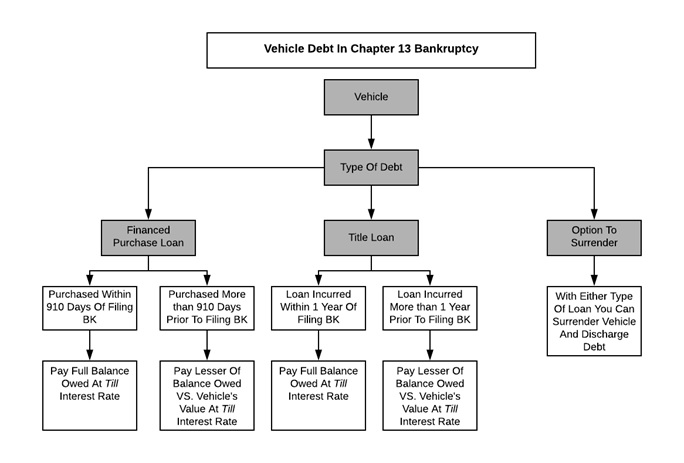

There are several different ways in which your car must or may be treated in a Chapter 13 bankruptcy. It is important to understand what options you have or what you will be forced to do with your vehicle in a Chapter 13 before your case is filed. After you read this post complete our online intake form to allow me to assist you in analyzing your situation.

1) Paid Off

Chapter 13 is often filed by individuals who are behind on their car payments and need to stop the creditor from repossessing the vehicle. But, you do not have to be behind on your car to file a Chapter 13. Chapter 13 will deal with the debt you owe on your vehicle regardless of the status of your vehicle’s debt. The bottom line in most Chapter 13 bankruptcies (click here to find out more about Chapter 13) is that your vehicle will be paid in full through the bankruptcy. At the end of your bankruptcy, you will receive the title to the vehicle. The questions that have to be answered (discussed below) are (1) what amount will you pay to satisfy the debt owed?; (2) at what interest rate will the debt be paid?; and (3) do you actually want to keep the vehicle or surrender it and walk away from the debt?

Before answering those questions I want to point out a very rare situation where your car will not be paid off through the bankruptcy. If this occurs, then you will make the vehicle’s normal monthly payment through your bankruptcy payment. At the end of your bankruptcy you will still owe on the vehicle and will resume making payments directly to the creditor until it is paid off. Having this situation occur in your bankruptcy will depend on the timing of when the vehicle was purchased and the terms of the vehicle loan.

For example: you entered into a financing agreement to purchase a vehicle in March. The terms of the agreement are that you will pay $400 per month for 72 months. Because of a quick downturn in your situation, you file a Chapter 13 the very next month. Your Chapter 13 payment will include the $400/month payment for the vehicle. At the end of your 5 year bankruptcy, you will resume making payments directly to the finance company until the vehicle is paid in full.

2) Pay The Value VS. Pay What Is Owed

Again, in most Chapter 13 bankruptcy, the individual will pay off the amount required to receive their car’s title at the end of the bankruptcy. The question in each individual case is: how much has to be paid in order to satisfy the debt? The answer to this question depends on the type of loan against the vehicle and the timing of when the vehicle loan agreement was signed.

Financed Vehicle. Here I am discussing the classic example of the vehicle you financed beginning the day you took it home from the dealership. You entered into a finance agreement either at the dealership or at a bank and the loan was used to purchase the vehicle. When you file a Chapter 13 with this type of loan, the debt owed will be satisfied through your Chapter 13 payment (in most cases) and you will receive the vehicle’s title at the conclusion of your case.

The question of how much you will pay to the creditor will depend on when the vehicle was purchased. The Bankruptcy Code has created the “910 Rule” to determine the amount that has to be paid.

If you purchased the vehicle within 910 days (2½ years) of your bankruptcy filing, then you have to pay the entire balance of what you owe. For example: your vehicle was purchased on January 1, 2017 and your bankruptcy is filed January 1, 2018. The balance owed on the vehicle is $10,000 and the vehicle is currently valued at $5,000. Because the vehicle was purchased within 910 days of your case being filed, you will have to pay back the full $10,000. Over the course of your 5 year bankruptcy and at the current Till interest rate of 7.25%, you will pay approximately $199.19 each month on the vehicle.

If you purchased the vehicle more than 910 days (2½ years) before your bankruptcy filing, then you will pay back the lesser of the balance owed OR the value of the vehicle. For example: your vehicle was purchased on January 1, 2017 and your bankruptcy is filed October 1, 2019. The balance owed on the vehicle is $10,000 and the vehicle is currently valued at $5,000. Because the vehicle was purchased more than 910 days prior to your case being filed, you will pay back the value of the car ($5,000) rather than the full balance owed ($10,000). Over the course of your 5 year bankruptcy and at the current Till interest rate of 7.25%, you will pay approximately $99.60 each month on the vehicle. At the end of your bankruptcy any amount remaining owed on the vehicle will be discharged and wiped away.

Title Loan. Here I am discussing the situation where you have fully purchased your vehicle but then have used your vehicle’s title as collateral for a loan. These are often called “title loans” and will be satisfied through your Chapter 13 payment. At the end of your bankruptcy, you will no longer owe this debt and will receive the vehicle’s title.

How much you will pay the creditor will depend on when the title loan was incurred. The Bankruptcy Code has created the “1 Year” rule to determine the amount that has to be paid.

If you incurred the title loan within 1 year of the bankruptcy filing, then you have to pay back the entire balance owed. For example: you previously paid your vehicle off, had its title, and then incurred debt using the vehicle as collateral by giving its title to the new creditor. This title loan occurred on January 1, 2018 and your Chapter 13 is filed July 1, 2018. The balance owed is $6,000 and the vehicle is currently valued at $3,000. Because the title loan was incurred within 1 year of your case being filed, you will pay back the full $6,000. Over the course of your 5 year bankruptcy, and at the current Till interest rate of 7.25%, you will pay approximately $119.52 each month on the vehicle.

If you incurred the title loan more than 1 year before your bankruptcy filing, then you will pay back the lesser of the balance owed OR the value of the vehicle. For example: you previously paid your vehicle off, had its title, and then incurred debt using the vehicle as collateral by giving its title to the new creditor. This title loan occurred on January 1, 2018 and your Chapter 13 is filed March 1, 2019. The balance owed is $6,000 and the vehicle is currently valued at $3,000. Because the title loan was incurred more than 1 year of your case being filed, you will pay back the value of the vehicle ($3,000) rather than the full balance owed ($6,000). Over the course of your 5 year bankruptcy, and at the current Till interest rate of 7.25%, you will pay approximately $59.76 each month on the loan. At the end of your bankruptcy any amount remaining owed on the vehicle will be discharged and wiped away.

3) Cramdown The Interest Rate

When paying the debt owed on your car (either the vehicle finance loan or title loan) in a Chapter 13 bankruptcy you will pay the amount required (either the balance owed or the vehicle’s value) plus interest. Most likely you will pay what is known at the Till interest rate in your Chapter 13. Although, I will discuss one situation below where you may choose to pay the interest rate originally agreed upon by you and the creditor.

Cramdown Interest Rate. In most Chapter 13s you will pay back the required amount on your car at a lower interest rate than you are currently paying. This can have great benefits as it could reduce the monthly payment paid toward the vehicle loan, giving you more money each month to pay for your necessities. The Supreme Court established what is called the Till interest rate to establish the rate at which debt secured by personal property (i.e. your car) is to be paid through your Chapter 13. The current Till interest rate (as of 10/2019) is 7.25%, but this rate fluctuates. Below is a graph of the recent fluctuations in the Till interest rate.

For example: you purchased your car on January 1, 2019 and file your Chapter 13 on October 1, 2019. You currently owe $15,000 at an 18% interest rate creating a monthly payment of $380.90. In your Chapter 13 you will pay the full balance owed ($15,000) but at the current Till interest rate of 7.25% creating a monthly payment of $298.79.

Till Interest Rate Fluctuations

As Of October, 2019

|

Date Bankruptcy Was Filed |

Till Interest Rate |

| September 1, 2019 and later | 7.25% |

| February 1, 2019 – August 31, 2019 | 7.50% |

| November 1, 2018 – January 31, 2019 | 7.25% |

| August 1, 2018 – October 31, 2018 | 7.00% |

| May 1, 2018 – July 31, 2018 | 6.75% |

| Prior to May 1, 2018 | 6.50% |

Protect Cosigner On Vehicle. You may have cosigned (or someone cosigned with you) on a vehicle loan. Whether you are the first or second signer on the loan, you are still 100% liable for the debt and the debt must be disclosed and dealt with in your bankruptcy. It is likely that the person who cosigned with you on the loan is a family member whom you do not want to be negatively affected by your current debt situation. If you file a Chapter 13 with a cosigned vehicle loan and you want to protect the cosigner, then you will pay back the agreed upon interest rate rather than the Till interest rate. You will not get the benefits of the lower interest rate, but stretching the balance owed over the 5 year bankruptcy can possibly reduce the monthly out of pocket expense on the loan.

For example: you and your son cosigned on a vehicle that you currently drive and which you are currently making the monthly payments. The balance owed is $10,000, the interest rate is 10%, the monthly payment is $400, and you have 3 years remaining on the loan. You desire to protect your son (the cosigner) through your Chapter 13 bankruptcy by paying the 10% interest rate. The monthly payment toward your vehicle over the 5 year bankruptcy will be $212.47

4) Option: Turn In The Vehicle And Discharge The Debt

Instead of keeping your financed car (or a vehicle used as collateral on a title loan) and paying for it through your Chapter 13, you may choose to surrender your interest in the vehicle and discharge your liability for the debt. This may be a good option if you have too many financed vehicles, want to rid yourself of a vehicle which you are upside down on, or have another non-financed, reliable source of transportation.When you choose to surrender your vehicle in a Chapter 13, you literally give it to the bank or finance company. They are able to sell the vehicle and apply the proceeds to the balance owed. If there is any amount still owed on the balance after the vehicle is sold (which is highly likely), then the balance is treated as an unsecured debt in your bankruptcy. In most Chapter 13s, unsecured debts are paid only a small percentage (if any) of what they are owed (I have discussed this in more detail in a separate post).