What Does Chapter 7 Bankruptcy Do With The Debt I Owe?

In A Nutshell

1) Secured Debt

2) Unsecured Debt

3) Taxes

4) Alimony And Child Support

In More Detail

1) Secured Debt

Secured debts are those which you (the borrower) pledge an asset you own as collateral for money that is loaned. The most common secured debts are a mortgage (secured by land) and vehicle loan (obviously secured by a vehicle). The result of not paying a secured debt is that the asset used as collateral is taken back by the creditor. This is often done by foreclosures of people’s homes or repossessions of their vehicles.

In a Chapter 7 bankruptcy and with most secured debts, you get to decide whether to keep the collateral and continue to pay for the debt OR surrender the collateral to the bank/finance company and cease paying the debt. For purposes of this discussion, I will use the example of a car that you have financed.

Your FIRST OPTION is to keep the car. You will continue to pay the car loan directly to the bank, as if you had never filed bankruptcy, until the car loan is paid in full. Chapter 7 does not change the terms of your vehicle loan agreement. Bottom Line: if you want to keep your car, then continue to make your car payments despite your Chapter 7 until the loan is paid in full. You may desire to sign a reaffirmation agreement with your creditor. I will explain this in a later post.

Your SECOND OPTION is to surrender the car and discharge your liability for the car loan. Practically, when you surrender your car you will actually give it to the bank. You will arrange to drop it off at an agreed upon location or request that the bank tow it from wherever it may be located. Bottom Line: if you do not want to keep your car or its loan, then you can let the bank have the car and wipe away your liability for the car loan in a Chapter 7.

As is the case with most secured debts, you get to make this decision…not the Court. BUT, there are situations where you may have too many secured items (i.e. 3 vehicles secured by loans and only 2 drivers in the household), and the Court can force you to surrender one of the vehicles. It is important to properly assess your situation through the prism of the Bankruptcy Code before you file a Chapter 7. Fill out our online intake form to let me assist in making this decision.

2) Unsecured Debt

Unsecured debts are those where there is no collateral acting as security for the debt. You (the borrower) simply agree to pay back the debt owed. The typical unsecured debts that individuals incur are credit cards, personal loans, and medical bills. The result of not paying an unsecured debt is that action is taken against you to “encourage” you to pay. These collection efforts often take the form of collection calls, collection letters, and lawsuits.

In a Chapter 7 bankruptcy, your unsecured debts will be wiped away. You will no longer be liable for any unsecured debts after receiving your Chapter 7 discharge. All of your unsecured creditors will forever be barred from attempting to collect the debt from you.

I often get asked, “If I file a Chapter 7, can I leave out one small credit card?” My answer is always, “No.” Chapter 7 is an all or nothing thing when it comes to your unsecured debt. You do not get to pick and choose what is or is not included in your bankruptcy. Rather, every creditor you owe must be listed in your bankruptcy petition and dealt with appropriately.

You can find solace in 2 things. (1) When your bankruptcy ends, you can (out of the goodness of your heart) reach back out to a certain creditor and begin paying them again. You will not be liable for the debt and paying the debt will not assist in repairing your credit score, but you can reengage payments to a creditor if the creditor will accept. (2) Your Chapter 7 will last for about 4 months…meaning you will file your case and be done with it in 4 months. After the conclusion of your bankruptcy, you will be able to incur debt. You will actually be surprised by the amount of credit card applications you will receive in the mail. While incurring new debt may not be advisable, you will be able to get a credit card with a low limit if you desire.

3) Taxes

Certain debts are given priority status in Chapter 7. These debts are typically unsecured debts (certainly not always) but do not receive the same treatment in bankruptcy as discussed above. The most common priority debts are certain taxes owed to the government, child support, and alimony (I will talk about the last 2 in the next section).

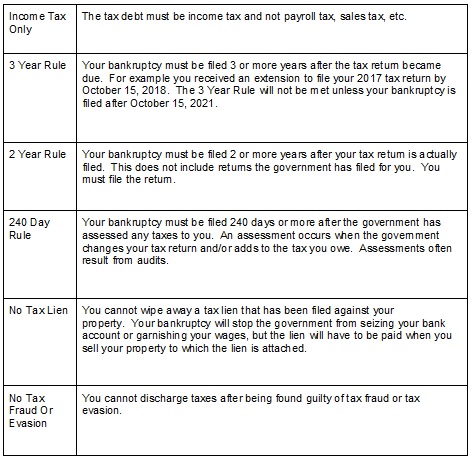

Taxes are hard to get rid of in a Chapter 7 bankruptcy but can be discharged if certain elements are present. All of the following must be met in order to discharge your liability for taxes in a Chapter 7:

4) Alimony And Child Support

As a general rule: alimony and child support are non-dischargeable through a Chapter 7. A Chapter 7 will not allow you to wipe away your liability for ongoing alimony or child support payments nor past due alimony or child support.