7 Things To Give Your Attorney To See If You Qualify For Chapter 7 Bankruptcy

Click Here For Your Free Bankruptcy Evaluation

In A Nutshell

(1) Paystubs

(2) Expenses

(3) Tax Returns

(4) Assets

(5) Debts

(6) Household Size

(7) SOFA

In More Detail

(1) Paystubs

Bring me your paystubs for the last 6 months. The first step in determining if you can file a Chapter 7 bankruptcy is looking at your household income to see if you qualify. This typically comes to me in the form of paystubs but could also be a profit and loss statement (described in more detail in a prior post – click here) if you are self-employed.

Notice that I need to know your household income. You will need to provide me with the income information for everyone living in your home with whom you share expenses. For example, when determining whether or not a happily married man can file a Chapter 7, the Bankruptcy Code requires me to look at his income as well as his wife’s income even though his wife is not filing the bankruptcy.

The purpose for providing me with your income information is twofold. First, I will need to know your gross income (before any deductions) for the last 6 months to see if you qualify for a Chapter 7 through what the Bankruptcy Code refers to as the “Means Test.” Second, I will need to look at a snapshot of your budget…your current income versus your current expenses.

(2) Expenses

Bring me a list of your household expenses. As mentioned above, I need to know your household’s budget (income vs. expenses). Because I needed your household income, I also need your household expenses. For example, if only a husband is filing, I need to know the expenses for he and his wife if they are not legally separated. Below is a word document of a list of possible household expenses that you can use as a guide.

(3) Tax Returns

Bring me your last filed tax return. When determining whether or not Chapter 7 is an option for you, I will need to review your last filed tax return unless it has been several years since the last time you were required to file. Your tax return will provide me with information regarding your income for the previous year as well as other pertinent information. After your Chapter 7 is filed, I will provide this most recent tax return to the Bankruptcy Trustee assigned to your case.

Bring me tax returns for years you owe taxes. Some taxes can be wiped away (discharged) through a Chapter 7. Determining whether taxes are discharged depends on the age of the taxes and when your tax returns were filed. If you owe taxes for certain years, then it will be useful for me to review those tax returns prior to your case being filed.

(4) Assets

Bring me a list of the assets you own. When you file bankruptcy you have to disclose all of the property you own or have an interest and disclose the values of each asset. At times this property has debt attached to it and other property you own free and clear. I need to know about both.

In a bankruptcy you are allowed to own a certain amount of property. The Bankruptcy Code (and NC State Law) has created limits on the value of property you can own through what it calls “exemptions.” If the value of your property falls under the exemptable limits, then you have no issue in filing a Chapter 7. If the value of your property falls above the exemptable limits, then you could possibly lose the property in your Chapter 7 bankruptcy.

After you give to me a list of your property, I will assist you in determining the value of the property. Obviously this is a very important analysis that needs to be accurate to determine if you will: (1) file Chapter 7 and keep all of your property; (2) file Chapter 7 and lose some property; or (3) in order to keep all of your property look at Chapter 13 or other options.

(5) Debts

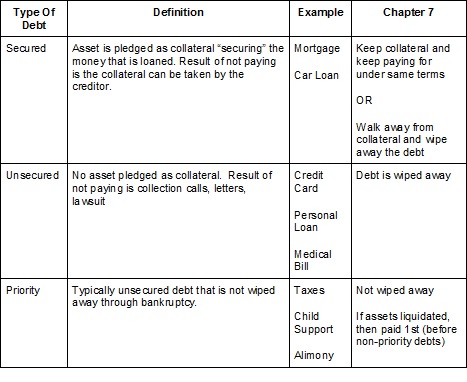

Bring me a list of your debts and credit report. For me to properly advise you on what a Chapter 7 bankruptcy will do for you, I need to know who your creditors are, the balances owed, the approximate dates the debts were incurred, and the type of debt (secured or unsecured). I typically request that my prospective clients bring to me a list of their debts, statements from their creditors, and/or a copy of their credit report. My assistant can assist in getting your credit report in our office, or you can obtain a free credit report yourself at this link.

Chapter 7 treats different debts differently. Below is a graph that explains how secured, unsecured, and priority debts are treated in Chapter 7.

(6) Household Size

Bring me a list of everyone who lives in your house. I need to know your household size to determine if you qualify for a Chapter 7. I need to know the ages of the individuals and their relationship to you.

Who is included in your “household”? The size of your household for bankruptcy purposes is not always the easiest thing to determine. Your spouse (if not legally separated) is a part of your household. Your children/dependents that you claim on your taxes are included if they are living with you. Children/dependents can get a little confusing when you have a shared custody arrangement with another parent.

Keep in mind that it is not always the case that everyone living in your home is a part of your “household” for bankruptcy purposes. You may share a home with a roommate who has totally separate bills from you. If so, then this roommate is not included in your household.

Why is “household” size important? Your household size will be factored in with your household income to determine if you qualify for Chapter 7. As discussed above, the Bankruptcy Code has set “limits” on the amount of income your household can earn and file a Chapter 7.

If your household makes “too much” income (above the median income in your area), then you will not qualify for a Chapter 7. If your household makes less than the median income, then you will qualify. The bigger your household the more income you are allowed to make and qualify for a Chapter 7. Below are the statistics as of 6/2019 of the median income for North Carolina (here is a link to the full graph on the Justice Department website). Keep in mind that these numbers constantly change up or down and this graph should not be relied upon to determine if you qualify for Chapter 7:

| Household Size | Median Income (Annual) |

| 1 | $48,629 |

| 2 | $61,882 |

| 3 | $68,853 |

| 4 | $85,021 |

| 5 | $94,021 |

(7) SOFA

Bring me answers to the questions in the SOFA. Every bankruptcy petition contains a schedule entitled the Statement Of Financial Affairs (“SOFA” for short). The SOFA contains several important questions allowing you to disclose detailed information about your recent past. Answering the questions is pretty straightforward as you will be able to answer most from memory or be able to easily look up the answers. But, your answers could have serious consequences to your Chapter 7. By clicking here you can download the SOFA and begin to contemplate your answer to each question.