3 Reasons Why You Need An Attorney To File Bankruptcy

In A Nutshell

(1) Complexity Of Bankruptcy

(2) Counseling During The Bankruptcy And Beyond

(3) Investment = High Return

In More Detail

(1) Complexity Of Bankruptcy

“You don’t know what you don’t know.” I am not sure who to credit with this quote, but it is certainly true when it comes to the law of bankruptcy. All bankruptcies must follow the Bankruptcy Code. The Bankruptcy Code, like a lot of legal statute, is written in hard-to-understand legalese. My law school bankruptcy professor taught me that when looking for answers in the Bankruptcy Code I must read the statute, read it again, then read it again. Understanding the meaning of the Code can sometimes be difficult for bankruptcy attorneys. It will certainly be difficult for someone who has never filed a bankruptcy but is trying to do so pro se.

When filing a bankruptcy, you create an open door into your life. You file a bankruptcy petition that details seemingly everything about you. You submit this petition to the Court under oath, meaning that failing to disclose information can result in you not receiving the benefits of the bankruptcy or, in extreme cases, being charged criminally with perjury. It is of the utmost importance that your bankruptcy petition is submitted with accuracy and completeness. An attorney will discuss with you all that is needed as well as do his/her own research of your assets to ensure that your petition is properly submitted.

There is also the question of which type of bankruptcy you should file (Chapter 7 or Chapter 13). Many factors of your life are considered and must be analyzed to determine which type, first, you qualify for and, second, is best for you. Filing the wrong type of bankruptcy can be severely detrimental to the goals you seek through a bankruptcy. This analysis is something that I, and other bankruptcy attorneys, do on a daily basis for individuals/couples who are considering filing a bankruptcy.

(2) Counseling During The Bankruptcy And Beyond

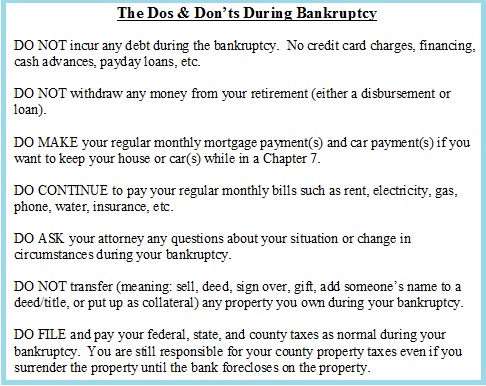

There are many things you can and cannot do while in a bankruptcy (see a list of some of the Dos and Don’ts below). The pitfalls within a bankruptcy are numerous and not always obvious. If you fall into one of these pitfalls, then the consequences to your case could be severe. Failing to follow all of the complex rules of the Bankruptcy Code in a Chapter 13 can result in a payment increase (possibly making the payment unaffordable) or being kicked out of the Bankruptcy altogether. Making a mistake during a Chapter 7 can result in you not receiving your discharge, meaning your debts are not wiped away.

Having an attorney when filing a bankruptcy will provide you with a knowledgeable resource to guide you through your bankruptcy. I always counsel my clients to contact me BEFORE engaging in a questionable act. When asked the question, I will either advise the client that there is no problem with doing what they desire to do or that the act cannot be done without court approval first or that the act simply cannot be done while the client is in the bankruptcy.

Following a bankruptcy you will be in a must different situation then you were before the bankruptcy. You will not have the same creditor issues! Questions and possible issues may arise in your life that are connected to the bankruptcy filing. For the most part, answering these questions you have do not come at an extra fee to your bankruptcy attorney.

(3) Investment = High Return

Having a bankruptcy attorney represent and counsel you during the bankruptcy is a small investment compared to the return you receive. As mentioned above, most things about bankruptcy are somewhat complicated and foreign to someone who is doing it for the first time. The Bankruptcy Code is laden with many pitfalls that can have severe consequences to you and your bankruptcy case. Counsel for your situation occurs during and after the bankruptcy.

The attorney fee will vary depending on the law firm you choose, the complexity of your case, and the type of bankruptcy you file. But, the attorney fee (in most cases) is only a fraction of the debt that is discharged through your bankruptcy case. I have found that our rates are very competitive compared to other local law firms. Fill out our online intake form or call to schedule a face-to-face free consultation. I will let you know, for free, if bankruptcy is/is not a good idea and what bankruptcy will look like for you.